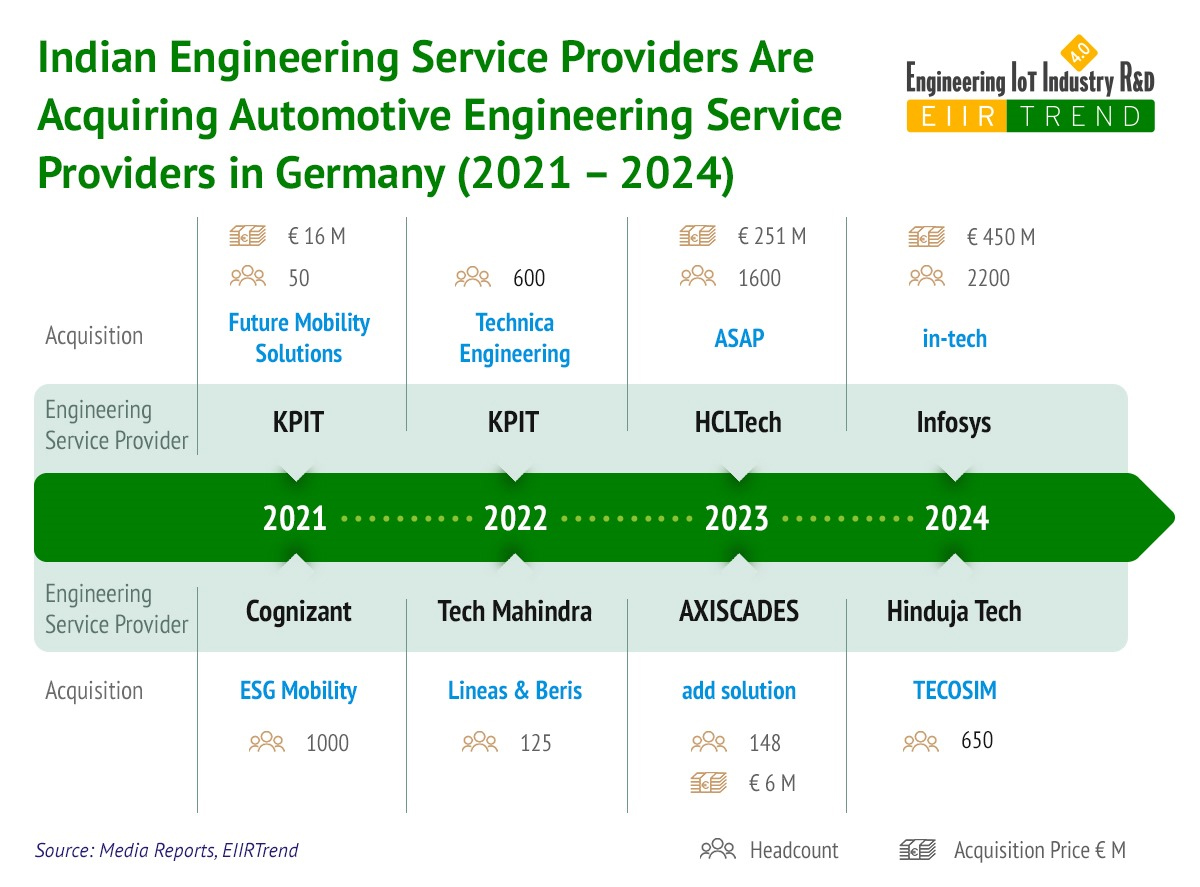

Indian engineering service providers have been actively acquiring automotive engineering firms in Germany. Over the past four years, companies like Infosys, HCL, Cognizant, Tech Mahindra, KPIT, Axiscades, and Hinduja Tech have completed eight significant acquisitions, highlighting their strategic expansion in this important market.

But Why? Let’s discuss this.

- Why Automotive? The automotive engineering services sector presents a vast market opportunity, being the largest segment within engineering services. Despite challenges facing the automotive industry, these very challenges are creating strong growth opportunities or tailwinds for engineering service providers. The automotive sector accounts for a significant share of total engineering spend, an even larger share of engineering outsourcing spend, and an especially high proportion of large engineering deals. (Read our earlier note Automotive Tail Wind for Engineering Services)

- Why Acquisitions? Acquisition is a key strategy for building capabilities in the automotive engineering services sector. Developing these capabilities organically is challenging, particularly in this highly specialized field. Many IT service providers have automotive clients but lack the engineering expertise and credentials needed to secure engineering work. These credentials include specialized engineering talent and strong customer references. Often, the only way to gain access to customers is by acquiring an existing engineering service provider. Even for established players in automotive engineering, expanding into new areas is difficult, and acquisitions offer a fast-track solution to build the necessary capabilities and credentials

- Why Germany? Germany is one of the world’s top three automotive engineering hubs, alongside Japan and Detroit, hosting numerous OEMs and tier-1 suppliers. For any automotive engineering service provider, having a significant presence in Germany is crucial. However, building and scaling a footprint of technical automotive experts in Germany is challenging without strategic acquisitions.

- ·Why Now? This is the ideal time for automotive offshoring due to two main factors: increased willingness of enterprises to offshore and the growing importance of cost efficiency, with India being the top choice for both. The pandemic has shifted perceptions, showing that engineering, once thought too core to outsource, can be effectively offshored, especially to India, where talent is abundant and affordable. Additionally, as R&D budgets tighten amid industry disruptions, offshoring becomes a strategic move to maintain competitive output. Acquiring automotive engineering service providers now will leverage these trends.

Value Creation Path

Infosys acquired in-tech for Euro 451 million in 2024. Our PoV explores the details of this acquisition and how it could potentially become a strategic growth opportunity for Infosys. (Read here).

The value creation path will be more or less similar for other automotive acquisitions in Germany too. The difference will lie in ambition, strategy, and execution.

Some Caution

Indian automotive engineering service providers are beginning to encounter client-specific challenges, creating short-term hurdles. The first issue stems from a shift in new product development priorities among automotive OEMs due to the current macroeconomic environment. Some earlier EV programs have ended and new ones have been delayed, reflecting a strategic pivot driven by their limited success in EVs and a growing industry focus on hybrids, energy-efficient ICEs, and other alternatives. The second issue involves increasing partnerships between automakers, such as Volkswagen and Rivian, leading to joint or shared R&D efforts. This shift is altering R&D strategies and, in turn, affecting engineering engagements with Indian service providers.

Indian engineering service providers, especially those who have made or are planning acquisitions in automotive engineering in Germany, must remain vigilant about these changing industry dynamics, client-specific challenges, and their potential impact on engineering outsourcing.

Bottom Line: We anticipate that more engineering service providers will pursue automotive acquisitions in Germany in the near future, driven by both demand and supply factors. Valuable assets are available in the market, and Indian engineering service providers are finally becoming more ambitious. However, there are short-term challenges and client-specific issues to navigate. Despite these hurdles, the long-term business case for moving more engineering and R&D work to India remains strong, thanks to cost and talent advantages. Fortune favors the brave!

Pareekh Jain

Founder of Pareekh Consulting & EIIRTrends

Pareekh Jain

Founder of Pareekh Consulting & EIIRTrends

Add comment