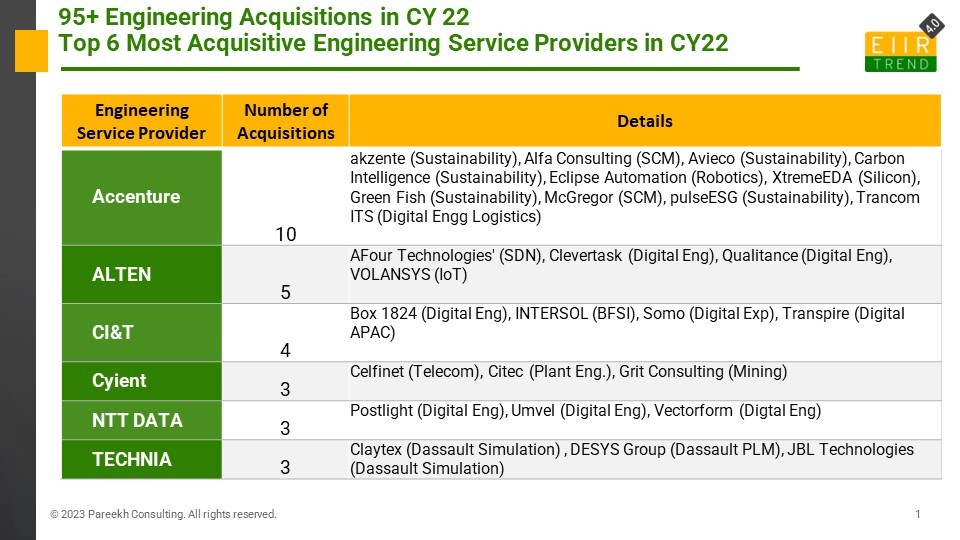

There were more than 95 acquisitions in engineering services in 2022, tracked by EIIRTrend. (Read our detailed research on Engineering Service Provider M&A in 2022 here).

And more than 25% of those acquisitions are by these six engineering service providers: Accenture, ALTEN, CI&T, Cyient, NTT DATA, and TECHNIA.

Acquisition is one of the major growth drivers in engineering services. A few reasons why acquisitions are more important in engineering services compared to, say, IT services or BPO are discussed below:

- Lack of large deals in engineering services

- Technical expertise is valued more in core products and services

- Organically very difficult to grow in new areas in engineering services

- The geography footprint of technical experts is difficult to establish and scale

- Sometimes the only way to get customer access is to acquire one of the existing engineering service providers

- Niche expert talent is difficult to find

However, all acquisitions are not the same. There are nine types of acquisitions I see in engineering services:

- · Vertical Expertise: Acquisition for specific industry vertical expertise such as automotive, aerospace, telecom, medical devices, and semiconductor in engineering services. Accenture acquisition of XtremeEDA is an example of acquiring semiconductor expertise.

- Horizontal Expertise: Acquisition for specific horizontal expertise such as Industry 4.0, industrial automation, PLM, software product engineering, embedded engineering, silicon engineering, design engineering, and plant engineering. Cyient acquisition of Citec is an example of acquiring plant engineering expertise.

- Geography Footprint: Acquisition for increasing delivery footprint in different geographies. HCL’s acquisition of Starschema is an example of augmenting delivery capability in Eastern Europe.

- Emerging Area/ New Technology: Acquisition for access to emerging technologies. Accenture’s many acquisitions in 2022 are for acquiring capabilities in sustainability.

- IP/ Solution: Acquisition of IPs from enterprises. This year CT Ingenieros’ acquisition of Infodream MES software is an example of a solution-driven acquisition. In past years acquisitions of IBM IPs by HCL, Persistent, Wipro and Tech Mahindra were good examples of IP-driven acquisitions.

- Customer Access: Acquisition for access to key customers. Many acquisitions, especially by pureplay engineering service providers, are in this category.

- Talent Access: Acquisition for access to talent in specific geographies and niches. The majority of Accenture’s acquisitions in Industry X are acquisitions for talent in specific geographies and niches.

- Business Model: Acquisition for trying new business model. Movate’s acquisition of Directly’s OnDemand business unit with the platform for freelancers is a good example.

- Building Scale: Private Equity led acquisitions combining smaller service providers to attain scale. Kedaara Capital led integration of GS Labs and GAVS is a good example.

- Partnership Strengthening: Acquisition of engineering ISV partners for strengthening capabilities and relationships. TECHNIA’s acquisitions of Dassault partners in different countries are good examples.

All engineering services acquisitions show one or more of the above shades. Some acquisitions have multiple shades too.

Acquisitions are not only relevant for small firms or mid-tiers to get scale, but even leaders will also need acquisitions for growth and remain relevant. Acquisitions are best for new entrants, especially IT MNCs, which are entering into the engineering service space to build and scale capabilities. The long tail of engineering service providers will provide a steady acquisition pipeline for many years.

Bottom line: Acquisitions will remain a dominant strategy for new player entry, building scale, and acquiring capabilities in engineering. In 2022 we saw more acquisitions than in 2021 despite the slowdown in acquisitions in H2 2022. Now in this challenging macro situation, there looks to be a correction in valuations, and we might see more acquisitions in 2023 than in 2022.

Pareekh Jain

Founder of Pareekh Consulting & EIIRTrends

Pareekh Jain

Founder of Pareekh Consulting & EIIRTrends

Add comment