Which service providers can disrupt the IT services market? This question keeps coming in various shapes and forms in discussions with investors, enterprises, service providers, and professionals. Early identification of potential disruptors has advantages for all stakeholders.

Here the advice from Disruption Guru Late Profession Clayton Christensen is relevant. He studied disruption in detail in his career and wrote the iconic book Innovator’s Dilemma, which articulated the Theory of Disruption. According to him, disruption plays similarly in all industries, but metrics to check disruption vary in different industries.

In the IT service industry, according to Professor Christensen, the disruption metric to keep an eye on is the size of engagements with clients. Emerging service providers that will consistently show an upward trajectory of Revenue/Client metric while maintaining high growth will disrupt the market incumbents. The longer the trajectory greater the disruption potential of emerging service providers against incumbents.

Indeed that has happened in the last couple of decades in IT services. Indian IT service providers appeared on the global IT services stage in the 90s, and there was the question of whether Indian IT service providers will disrupt global IT service providers. Many Indian IT service providers eventually did and are now counted among the top IT service providers by revenue, headcount, or market cap.

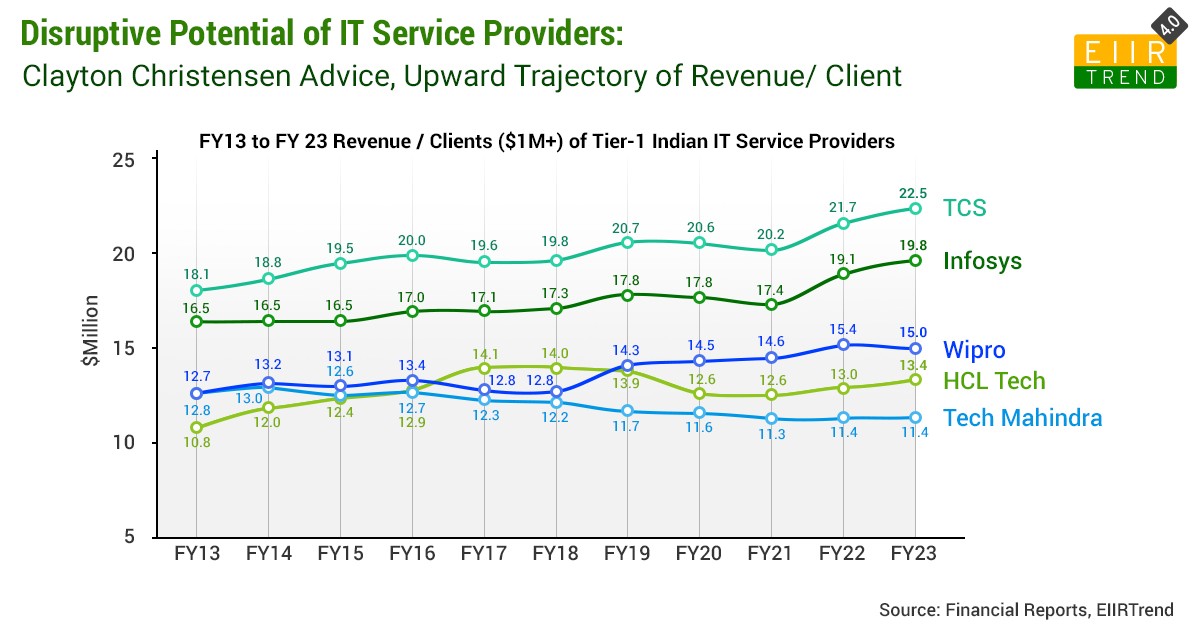

We plotted the Revenue/ Client ($1M+) trajectory of the top 5 Indian IT service providers for the last ten years. The total number of clients metric was not available for all service providers, so using the number of $1M+ clients. Directionally, Revenue/ Client ($1M+) will also highlight the same point. Also, sometimes there are accounts of small sizes because of tuck-in acquisitions, and also product/ tools sale and Revenue/Client ($1M+) can neutralize that impact to some extent.

TCS, Infosys, Wipro, and HCL Tech grew Revenue/Client ($1M+) during FY13-FY23

- TCS Revenue/ Client ($1M+) grew from $18.1M in FY13 to $22.5M in FY23

- Infosys Revenue/ Client ($1M+) grew from $16.5M in FY13 to $19.8M in FY23

- Wipro Revenue/ Client ($1M+) grew from $12.7M in FY13 to $15.0M in FY23

- HCL Tech Revenue/ Client ($1M+) grew from $10.8M in FY13 to $13.8M in FY23

All four leading Indian IT service providers have improved their standing in global IT services. Some service providers have improved more than others, which shows in their growth rates, market cap, and relevance in the IT services market.

The curious case of Tech Mahindra

- Tech Mahindra’s case is interesting. In fact the Revenue/Client ($1M+) for Tech Mahindra declined from $12.8M in FY13 to $11.4M in FY23

It brings us to the point can two mid-tiers combine and make a tier 1? Before that, let’s discuss the importance of growth in Revenue/ Client for IT service providers.

Why does growth in Revenue/ Client matter?

The upward trajectory of Revenue/ Client for a service provider shows the increasing relevance of the service provider to clients. This is the journey of a service provider from being a tactical supplier to a strategic partner. Enterprises work with many service providers, but they have strategic relationships with very few. And these strategic relationships don’t change that frequently. Large deals involving large transformation programs are often given to strategic suppliers.

While growth can be achieved by adding more clients, the relevance will increase by increasing revenue per client.

A caveat for niche service providers. They focus on one or two service lines, such as BPO, engineering, and analytics, and will have less potential to increase Revenue/ Client than broad-based service providers. Still, growth in Revenue/client matters to them as well. That way, they are becoming strategic partners to their customers.

Can two or more mid-tiers combine and make a big tier-1?

The jury is out. Many attempts have been made to bring the scale with acquisitions, and results have been varied. We think that acquisitions and scale are starting points for creating a platform for disruption. They need strategy and execution to become more relevant to their large customers than they were as mid-tiers. The metric to check is growth in Revenue/ Client.

Bottomline: Stakeholders can check growth in Revenue/ Client to see the growing relevance of service providers and their disruption potential. Service provider leadership should look for strategies to grow Revenue/ Client.

- Do they have the right customers?

- Are they their strategic supplier?

- Do they have the right capabilities, offerings, and value propositions?

- Do they have an effective sales engine?

If the answer to the above questions is yes, then Revenue/Client should grow.

Pareekh Jain

Founder of Pareekh Consulting & EIIRTrends

Pareekh Jain

Founder of Pareekh Consulting & EIIRTrends

Add comment